The future of digital lending: exploring the benefits of cloud-based platforms.

Explore the advantages of cloud-based platforms in digital lending, including scalability, flexibility, and enhanced data security.

In an era where technology drives transformation across industries, the financial sector is no exception. Cloud-based platforms are at the forefront of this revolution, offering unprecedented benefits for digital lending. These platforms are reshaping how financial institutions operate, providing flexibility, scalability, and enhanced security.

The Game-Changers

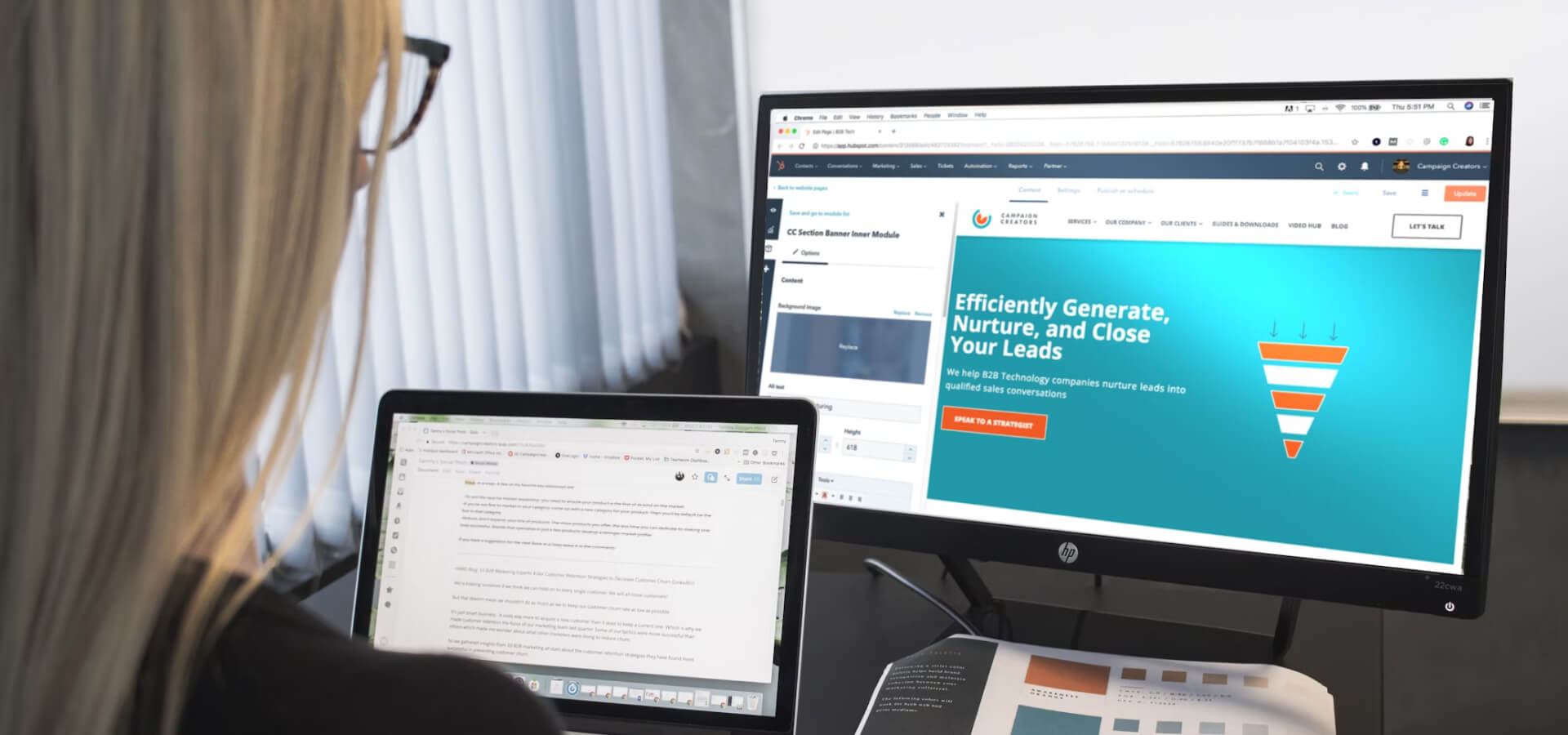

Cloud-based platforms are fundamentally changing the landscape of digital lending. By migrating to the cloud, financial institutions can streamline their operations, access data from anywhere, and scale their services quickly to meet growing demands. These platforms eliminate the need for costly on-premises infrastructure, reducing both capital expenditure and maintenance costs.

Transforming Operations

One of the most significant advantages of cloud-based platforms is their ability to streamline operations. Financial institutions can integrate various processes, from loan applications to risk assessments, into a single, cohesive system. This integration improves efficiency and reduces the time it takes to process loans. Additionally, the cloud offers real-time data access, enabling lenders to make quicker, more informed decisions.

Enhanced Security and Compliance

Security is a paramount concern for financial institutions, and cloud-based platforms address this with robust security measures. Advanced encryption, multi-factor authentication, and compliance with industry standards ensure that sensitive financial data is protected against unauthorized access and cyber threats. Furthermore, cloud providers regularly update their security protocols to adapt to new threats, ensuring continuous protection.

Cloud-based platforms are revolutionizing digital lending by providing financial institutions with the tools they need to operate more efficiently, securely, and flexibly. By embracing these technologies, lenders can improve their operational capabilities, enhance security, and better serve their customers. The future of digital lending is in the cloud, and those who adopt these innovative solutions will lead the way in the ever-evolving financial landscape.

Ready to take your business to the next level?

Whether you're looking to streamline operations, boost efficiency, or drive growth, Beta has the solutions you need.